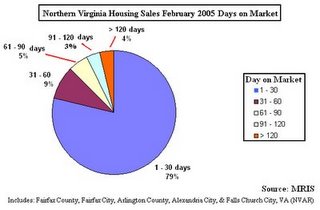

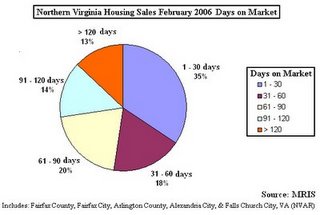

Bubble Meter has these two graphs contrasting housing sales in Northern Virginia last month and one year earlier:

There is definitely a slowdown in housing sales. Anybody have any idea how this will impact prices in the area? Will this just be a slowdown or will there be a significant market correction in housing prices? How does this compare with other areas nationwide?

My take: People tend to be loss averse and do not like the psychological impact of feeling like they've lost money. With all the recent rapid housing appreciation, my guess is that there will be a significant slowdown in the housing market in all of the "hot" areas nationwide. Since people try to avoid losses, they would prefer to hold onto a property rather than sell it for less than they could have made on it 6-months or a year ago. I believe this will lead to a very strong slowdown in sales, with prices adjusting downward, but not dropping by a large percentage. I think that is the trend these graphs are representing.

No comments:

Post a Comment