My friend Angela just tagged my with the question of how would I use $100 to do the most good? Specifically, the question is addressed to how would I do so as a Christian. In this context, it would be important to consider using the money to impact both the spiritual welfare (the Great Commission) and physical welfare (the Great Commandment) of others. Preferably something that has a magnified effect.

This question is a lot harder to answer than it first sounds. There are four considerations I'd take into account: potential impact, accountability, effectiveness, and incentives.

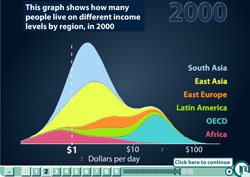

1) Potential Impact: For impact, I'd lean towards giving the money to an organization that does work overseas. I think the impact a dollar can have in the under-developed parts of the world has the largest potential to make a meaningful impact on the lives of others.

2) Accountability: What I mean by accountability is that it is important for an organization to have high levels of transparency for how they handle money which gives strong incentives towards being wise with expenditures and efficiently run.

3) Effectiveness: By effectiveness, I mean does the organization actually accomplish what they intend to accomplish? It's important to examine not only the intentions of organizations and people, but also their track-record for accomplishing the goals they set out to accomplish. Reading Thomas Sowell's book, "The Vision of the Anointed", was a very convicting read for me as a Christian. Basically Sowell argues that groups and individuals who base their actions on intentions without careful following-up of the results of their actions reveal they don't really care about the impact they have and are merely doing things to make themselves feel good. To contribute in a meaningful way, it is critical to be careful about what we do and make sure any organization we donate money to has metrics in place to monitor (as much as possible) the impact of what they do.

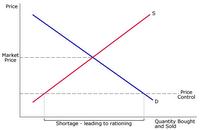

4) Incentives: When considering using money to help others, it's important to consider the incentives created by the actions you or the organization you are supporting take. For example, giving money to a beggar may help them eat their next meal, but it may also give them an incentive to stay on the street. (Fundamentally, is there a difference between giving a beggar money and paying him to stay on the street? The intentions are different, but you could argue that the incentives are the same.) While it's not always perfectly clear, it's important to think about what unintended consequences might occur due to your donation.

I hate saying it, but I am often inundated with requests in the mail for money for many different types of ministries. There is always an urgent need and new areas of expansion they are trying to undertake. I do not doubt the sincerity of any of these requests, but I often question the judiciousness of them. Are requests for more money being made because the organizations are being inefficiently run or because they are so successful they are blossoming? Are they expanding into an area complimenting what they are already doing or are they getting involved with something that distracts them from their main mission? Unfortunately it is usually very difficult to tell. That's the problem. The volume of requests from all organizations creates "noise" that hinders the requests of those sincerely needing more funds. The volume of requests often serves to damage the credibility of all of them and makes it tougher to sort out where the real need is.

I share all of this just to say that it is hard to know where money can be put to the best use. Here are some of my immediate thoughts:

1) Help Sponsor a Child: Send the money to help sponsor a child overseas with an organization you trust. I used to sponsor two kids in Haiti through New Missions. Another good organization is World Vision. This money is used to provide health-care (most impactful when given to the young), education, access to religious teaching, food, shelter, etc. A $100 donation would probably cover most expenses for a child for about 4-months. What is a small amount of money to us can be hugely impactful to them.

2) Support a Missionary: Missionaries are often working in areas with the most physical and/or spiritual poverty. Helping fund their efforts gives resources to someone directly involved in interaction with these individuals. Supporting someone you know personally helps solve some of the information problems involved with supporting large or unknown organizations. I know many people working for New Tribes Mission and am a big fan of their organization.

3) Donate to a Microfinance Organization: Organizations that give out microfinance loans help provide the poor overseas with funds to become self-sufficient entrepreneurs. The money is then repaid and the profits are used to lend to more entrepreneurs. Muhammad Yunus just won the Nobel Peace Prize for his work in Microfinance. While I realize there are some limitations to microfinance, my opinion is that it is a great way to help get some resources to people in need in a way that fosters accountability and productive incentives. I had the opportunity to work with a Christian microfinance organization in Moldova a couple years ago and was very impressed with what they were doing.

4) Give to Your Local Church: It may sound simple, but if you are active with a local church and are comfortable with their mission and management of their resources, this may be a good way to leverage your money to do the most good. Your knowledge of your church can help inform you in this area.

5) Support an Organization with Sound Financing: I'm a big fan of organizations that go the extra-mile to develop sound accountability in their financial matters. The Evangelical Council for Financial Accountability is a good service for Christian organizations to maintain and show good standards in the way they handle their money. Here is a list of their member organizations.

6) Help Build a Church Overseas: My Sunday School class (~100 members) raised money to build a church in India in 2002. I was blessed to be able to go visit the church in India in 2003, an experience that helped me make my decision to come back to school for my PhD. We worked with an organization called International Cooperating Ministries (ICM), which is a fantastic organization. I'm particularly impressed with ICM because they follow many incentive-friendly ideas that promote a streamlined organization that gets nearly 100% of donated funds to churches overseas. (If I remember correctly, all their overhead is supported by an independent foundation.) They require congregations they partner with overseas to commit to repaying the money given to them to a fund that is used to build more churches in their country. It is an example of a way a donation can have a multiplicative effect. While $100 alone won't build a church, if you can find another 50-75 people to contribute the same, you can.

7) One Red Paperclip: If I were to get a little more creative (whacky?), I might suggest taking a tip from Kyle MacDonald who made a series of fourteen exchanges to trade-up one red paperclip for a house. (Watch a video of Kyle's story.) It's a great story of an innovative idea that used the benefits of voluntary exchange (and a little publicity) to increase his value of each item during each trade. The beauty is that everyone else gained too. Using a similar idea, it might be possible to increase the monetary value of your $100 by buying something and engaging in trade for items you could then sell for more money and contribute whatever you make.

7) One Red Paperclip: If I were to get a little more creative (whacky?), I might suggest taking a tip from Kyle MacDonald who made a series of fourteen exchanges to trade-up one red paperclip for a house. (Watch a video of Kyle's story.) It's a great story of an innovative idea that used the benefits of voluntary exchange (and a little publicity) to increase his value of each item during each trade. The beauty is that everyone else gained too. Using a similar idea, it might be possible to increase the monetary value of your $100 by buying something and engaging in trade for items you could then sell for more money and contribute whatever you make.

These are just a few of the initial ideas that come to mind. I'd love to hear of any other ideas anyone has. To my economist friends, do you have any ideas for how to best leverage $100 to maximize the positive impact you can have on others?

Read my friends' Angela and Catherine's response to this question. Also, check out Tyler Cowen's thoughts on how to choose a charity and Slate's article on how should you spend $1 to do the most good.

What would you do with $100 to try to maximize the welfare of others?